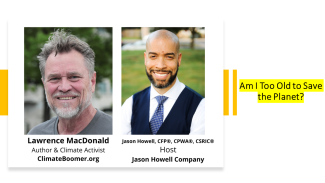

Am I Too Old to Save the Planet?

"Forget your perfect offering; just the ring bell that you can ring; there is a crack in everything; that's how the light get's in." None of us is perfect. None of us can do it all. But we all have a bell that we can ring.... we can all do more. Another thing we say in the movement, is move outside of your comfort zone. If the thing that you're doing to save a livable planet is really comfortable for you, you could probably be doing a little bit more."

- Lawrence MacDonald, Author, Am I Too Old to Save the Planet

Lawrence began his career as a reporter in Asia, where he saw first-hand how U.S. policies affected poor people in the developing world. Expelled from China for reporting on the student democracy movement, he became an expert in public policy communications, with a focus on poverty reduction and the environment, working at the World Bank, and serving as vice president of the Center for Global Development and the World Resources Institute, a global environmental think-and-do tank.

He is a writer, public speaker, and volunteer climate organizer who has been arrested several times in non-violent direct action to call attention to the climate emergency. He is active in Th!rdAct.org, experienced Americans working to protect democracy and a livable planet; Dayenu.org, a Jewish call to climate action; and ClimateDefiance.org,a youth-led group that disrupts powerful people who are blocking the transition to a low-carbon economy.

In our conversation with Lawrence, we discuss:

- Why isn't climate change a hoax?

- How did we get here (are Boomers to blame)?

- What can individuals do to make a difference?

- Why is faith advocacy important?

- What's the difference between "civil disobedience" and "non-violent action?"

- What is "the myth of pacifist persuasion?"

For more:

Jason Howell Company is a family wealth management firm that diversifies the portfolios and untangles the emotions associated with first generation wealth and family business. We help couples overcome financial imposter syndrome and family businesses diversify their risk and implement family governance structures.

Jason J. Howell, CFP®, CPWA®, CSRIC® and Douglas W. Tees, MBA, CFP® CAP®, CBDA have spent a lot of time in the Washington, DC area, and are aware that many people who are first generation wealth suffer from a kind of "financial imposter syndrome." Successful entrepreneurs are always looking over their shoulder; government contractors worry about the next contract; former Capitol Hill staffers privately wonder if they should "feel bad" for the money they now make. Imposter syndrome is common among people who work for the many corporate headquarters based in this area as well. These feelings get in the way of properly managing wealth. We empower them to get organized, build a team of advisors and make decisions.

Our typical "first generation wealth" families include dual income parents who work, save and have just the right amount of fun. We uniquely solve the typical problems that come with family owned businesses.

Our clients trend a little older - Baby Boomers (born 1946 - 1964) and Gen-Xers (born 1965 - 1980) - but we're starting to see more Millennials (born 1981 to 1996) who don't want to wait until it's too late. They earn impressive incomes and have accumulated a good bit of savings. As bona fide experts themselves, they expect fiduciary expertise from people they hire. They are just not sure about the "big box" brokerage firms that advertise one thing and seem to do another.

First generation wealth success stories and family business owners realize that they:

- Need to “do something” with the cash in their checking/savings

- Need to diversify their portfolio away from the family business

- Need an investment strategy for “up” and “down” markets

- Need a plan to mitigate market, credit, inflation, and political risks

- Need to start tax planning instead of just tax paying

- Need to be sure they are choosing the right work benefits

- Need to reduce financial miscommunications between partners

- Need to separate business finances from personal finances

- Need to plan for money while alive and for what happens after death