Politics, Profits and Portfolios

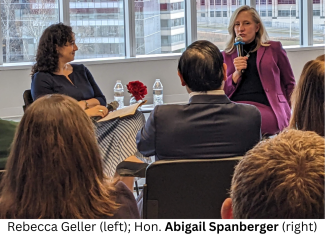

On January 12th I had the opportunity to attend a meet and greet with Congresswoman and Virginia Gubernatorial candidate, Abigail Spanberger. And I took it!

Congresswoman Spanberger is the first person to declare her candidacy for the 2025 election and I jumped at the chance to meet possibly, the 75th governor of Virginia. Virginia’s governors are limited to one consecutive term so there is guaranteed turnover every four years.

As many owners of family enterprises know, policy (regulation) and business go together. Our firm lives at the intersection of “wealth, ownership and family” because those are the three categories we are often asked to coordinate. Said another way, the most important levers of power are money, law and people. Most people, with or without money to preserve recognize how important law (policy) is to their wealth.

Lawmakers become an important constituency to understand, engage and if you’re a voter/donor, select. We are just shy of two years away from picking a new governor in Virginia. Like all elections, family (community), ownership (business) and money (always) are all on the line. More than wealth preservation, elections are also about community and family preservation.

Virginia and Fairfax County

Virginia is home to nearly 9 million residents and ranks #13 out of the 50 states in overall ranking by US News and World Report. Because Virginia’s state legislature hosts off-year elections, there is an election every November. Virginian’s select their next governor, the year after US Presidential elections. It almost feels like a national afterthought except that political pundits look to the party that wins Virginia’s governor’s mansion as an indicator of how the nation views the sitting US President’s party.

In 2023, Virginia ranked #2 on CNBC’s “Top States for Business.” This was up from the prior year ranking of #3 which was down from #1 rankings in 2021 and 2019. I’ve lived in Virginia for nearly all of my life. When my family moved here in October of 1987, I wasn’t aware of the stock market crash called “Black Monday” on October 19th, nor did I have any clue about the significance of the Federal Reserve Bank response. No, I was barely a teenager, just looking to fit back into public school (after having spent a few years prior in private school in a foreign country).

When my family moved back to the United States from Trinidad and Tobago – a visit that turned into 5 years – we landed in Fairfax County, Virginia. At the time, the population was growing at over 30% per year! Since 2011, Fairfax County hasn’t grown much more than 1% per year but with a population of over 1 million people, it’s a pretty powerful section of the state’s overall head count (about 12%). With a median household income of about $145K, it’s also the 5th richest county in the United States.

As Fairfax County goes, so goes Virginia! At least typically. Fairfax County is a large county that “votes blue;” Fairfax is what makes the Commonwealth of Virginia a so-called “purple” state. So it was not surprising that the (moderate) Democrat, Congresswoman Spanberger met in Fairfax County as a guest of the Democratic Business Council of Northern Virginia (DemBiz.org). I came by my invitation via a friend I was introduced to early on in my financial advisory career (2013): an award-winning estate planner, advocate and political consultant, Rebecca Geller. She also just happened to be a childhood friend of Congresswoman Spanberger and a Director on the DemBiz board.

Rebecca Geller

Besides being a mult-award winning estate planner, Rebecca is well known for her advocacy: from support the rights of the Jewish community to the rights of new moms. She’s been featured in the New York Times for championing work from home nearly ten years before the COVID-19 pandemic. She invited me – and all of her Facebook followers – to the event and I was happy to attend. As I tell my students at George Mason University’s newly named Costello College of Business, “Law and money go together.”

Virginia Law and Money

Starting with the very basics of law and money, there seems to be issues associated with Virginia’s campaign finance laws. Big corporate donors like Dominion Energy and large not-for-profit organizations like Clean Virginia take up a lot of the financial oxygen in Virginia politics. And when it comes to the politicians themselves, this so-called “part-time” legislature earns less than $30,000 per year (salary and per diems combined). It isn’t the lowest of the 50 states but it seems to be contributing to near “George Santos” level of campaign finance impropriety. The effect of money – compensation, fundraising – is huge in Virginia. And that has an affect on the economic (financial) laws that affect how families and communities are empowered to succeed.

Casinos, Sports and Hemp

To fully understand money it is important to understand where it’s being created. Fast changing laws and culture are poised to directly affect the Northern Virginia economy via three industries: gambling, sports entertainment and hemp.

Recently reelected State Senator Dave Mardsen (D-Fairfax) has become quite the advocate of sponsoring a casino in Northern Virginia; specifically Vienna/Tysons. Ten other politicians joined his point of view in a recent committee vote in the Virginia House of Delegates. The thinking from them and others – like the Northern Virginia Chamber’s President Julie Coons – is that diversifying tax revenue away from commercial real estate is a smart move. Diversifying tax revenue is smart but many residents who were passionate enough to travel to Richmond (Virginia’s capital) are opposed to the idea. This group seems to include the Fairfax County Board of Supervisors who have reportedly opposed having a casino in Tysons. How a casino would or would not affect the economy of Virginia and Fairfax County is an open question. What will eventually happen will be determined by the Virginia House, Senate, the Governor and Fairfax County. Law and money go together like politicians and profiteers.

A similar if not quieter story is building in Alexandria around hemp. The Virginia Mercury has reported multiple pieces on the lawsuit filed by Northern Virginia Hemp and Agriculture and others against new limits on hemp products sold in Virginia. The owner’s complaint has to do with the levels of THC - tetrahydrocannabinol or marijuana chemical – limits that changed after they produced merchandise for sale. They claim that they will have to close their business if the laws aren’t loosened (because they can’t afford to throw away so much product). Whether or not Virginia will bend the law for this company is another one of those open questions. How much weight does money have versus Virginia’s Attorney General’s shared concerns towards the “…rise of dangerous counterfeit THC-infused products marketed to our youth.” Decisions will be made for this company and in all likelihood revisited in the future.

Also in Alexandria, Monumental Sports announced last December a “framework” for bringing NBA’s Washington Wizards and NHL’s Washington Capitals to Alexandria. More than $1 billion of debt would need to be raised to build a stadium – and everything that goes with it – for these sports teams. How does that get paid for? Eventually, taxes. This deal seems to have the support of Virginia’s Governor. On paper, politicians are accountable to voters. Virginia’s next legislative session may decide the fate of this “monumental” – yes, I know – deal. If the deal and the move happens, it would go into effect in late 2028.

Looking Forward

There’s lots of money in gambling, sports and drugs. When it comes to money, politics, profits and portfolios are not-so-distant cousins. The issues being faced by Virginia now are being faced by governors and constituents all across the country.

Whomever is elected the new Virginia Governor in 2025, will have major economic decisions to make that will affect the culture of Northern Virginia and the entire Commonwealth of Virginia for at least the next 50 years.

The most important question to ask ourselves (and our politicians) is who do we want to become and how do we propose to get there?

For the sake of our communities, it is important that we ask that question. Too much cultural blood has been spilled in the name of “growing the economy.” Together, let’s make sure that those potential “injuries” are sustainable. Let’s investigate the costs as mercilessly as others have investigated the revenue.

And if you get the chance to attend a meet and greet with a gubernatorial, senatorial or house candidate, say “Yes!”

Jason Howell Company is a family wealth management firm that strengthens families making the transition from first generation success to family wealth. We envision a world where wealthy families give, grow and govern themselves in ways that enrich their local communities. We do this by reducing the fear, isolation and guilt associated with financial success.

Jason J. Howell, CFP®, CPWA®, CSRIC® and Douglas W. Tees, MBA, CFP® CAP®, CBDA have spent a lot of time in the Washington, DC area, and are aware that many people who are first generation wealth suffer from a kind of "financial imposter syndrome." Successful entrepreneurs and family businesses are always looking over their shoulder; government contractors worry about the next contract; former Capitol Hill staffers privately wonder if they should "feel bad" for the money they now make. Imposter syndrome is common among people who work for the many corporate headquarters based in this area as well. These feelings get in the way of properly managing family wealth. We empower them to get organized, build a team of advisors and make decisions.

Our typical "first generation wealth" families include dual income parents who work, save and have just the right amount of fun. For long-time, family owned businesses we focus on much family preservation as we do wealth preservation.

First generation wealth success stories and family business owners realize that they:

- Need to “do something” with the cash in their checking/savings

- Need to eventually diversify their portfolio away from the family business

- Need an investment strategy for “up” and “down” markets

- Need a plan to mitigate market, credit, inflation, and political risks

- Need to start tax planning instead of just tax paying

- Need to be sure they are choosing the right work benefits

- Need to reduce financial miscommunications between family members

- Need to separate business finances from personal finances

- Need to separate family wealth from individual wealth

- Need a plan to provide space for both family and individual philanthropy

- Need to plan for money while alive and for what happens after death