JOY of Managing Debt

Though the ubiquitous credit card wasn't invented - at least not here in the United States - until the Diners Club Card was created in 1950, carrying debt and managing credit has conceptually been around since the Age of Antiquity. You don't need me to tell you that debt starts controlling your life after a while if you're not careful. Here's how you can fight back the accumulation of debt and take back control.

On college campuses in the 1990s, it was pretty easy to get a credit card. Banks were easily lining up students with new opportunities for debt by giving away T-shirts. This was before the Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009.

Everyone seemed to get a credit card except for me; and I worked for a bank! Eventually I filled out a credit card application where I worked, assuming they had to give me a credit card. I had almost given up - I wish I had. Before I turned the application in, a fellow bank teller suggested I ask the district manager of our bank to sign off on my application. The next time Mr. David Wheeler - oddly, I still remember his name- came through, I asked. Mr. Wheeler to sign my application. And sure enough, I was approved for a $300 revolving credit line on my first credit card, courtousy of Household Bank. I would make the most of it (or so I thought).

In a short while, I made a plan to purchase the five CD changer with a dual-tape deck stereo I had been eying for months. This was the 90s and back then computers were for computing. Now, I figured the smart money was charging the nearly $300 stereo to my credit card - to build my credit of course- and pay it off with an expected tax refund. It seemed like a great idea at that time. Months later, I had both spent the tax refund and unfortunately, maxed out my credit card. But not to worry, I was smart: I had already applied for and received another credit card with a $500 credit line; which I would use to transfer the balance! Long story short, I eventually had two maxed out credit cards (thankfully for under $1,000 total). OK, maybe I wasn't that smart. It took me a bunch of years to get out from under what eventually turned into a bunch of revolving debt. Debt crept up on me, regardless of my good/seemingly smart intentions. Had I just followed through on the plan to pay off what I incurred immediately, it would not have cost me my 20s. Debt made me upside down, not only in my finances, but in things I wanted to do in life. Paying for dates, gas, clothes and higher rent were all a challenge. It took me awhile to learn that controlling my debt would put me in control of my expenses by limiting me once again to cash. Credit was unfortunately the "gateway drug" to debt and overspending. And I needed to break the (fortunately short-lived) habit.

Is Debt Bad?

Debt is an obligation that at some point, you will have to repay. It forces you to work when you would rather not, live in a home you would rather leave, and suffer situations you cannot change. At the same time, debt can be an alternative way to leverage your good reputation aka "creditworthiness." So, is it good or is it bad? The answer is obvious to me: debt is bad! Debt certainly isn't good. Why would anyone want to owe money? Why would it be a good thing to even need leverage? Wouldn’t it be better if you actually had the money you needed to buy what you wanted? Of course. So, if you don’t have debt, you don’t need it and you certainly don’t need to want it (like I did back in the 1990s). But if you already have debt, there is a joy in the discipline of getting rid of it.

Accumulating debt can happen slowly or all of a sudden. For many of us, it happens slowly, often through small charges on a credit card that don’t all get paid off every month, or over the course of earning a college degree. For others, it can also happen quickly; through a large purchase like a home or a medical bill that can’t immediately be repaid. Getting rid of debt takes great habits, steady income and sacrifices you may or may not have made along the way of accumulating the debt. Paying off debt may also require creativity; which could make becoming debt free more like a game and games are fun. Here are a few ways you can eliminate debt:

- Avalanche or Snowball Method

- Earn more money

- Negotiation & Bankruptcy

Avalanche Method or Snowball Method

Both of these popular methods for reducing debt will give someone in debt a couple of things they haven’t felt before: control. Most responsible people I know, including clients, will try to pay a little extra on all of their debts each month. This is not a recommended strategy. The initial step is to review all of your balances, minimum payments required, and interest rates. When you can see everything, you can prioritize the order in which you will pay them off. In both the Avalanche and Snowball methods, your strategy is to pay only the minimum amount required by all of your creditors except one. You choose one debt to effectively “pick on.” All of your attention and extra money you set aside for debt will go towards paying off that one debt fast (this is the gamification option where you pulverize one debt).. After that first debt is paid off, in however many months, you take the amount you had been paying to that debt and add it to the amount you were paying to the next debt in your order of priority. The avalanche method takes an academic approach to the order. It suggests paying off the higher interest debts first. Of course, this makes sense, because the higher interest is hurting you more financially. What this doesn’t take into account is your highest interest debt may be a student loan for $90,000, and your lowest interest debt may be $1,000 on a credit card. Paying down $90,000 of interest may take a couple of years, while the $1,000 debt may be taken care of in one or two paychecks. Why does this matter? Well, the advocates of the snowball method take a more behavioral science approach. The thinking is that paying off that $1,000 credit card in a couple months gives you an early “win” in your debt reducing commitment, and that win could be the encouragement that keeps you on your plan for the longer-term debt payoff. I tend to agree with the thinking behind the snowball method, but have had clients who favored the avalanche method for its mathematical advantage. Whichever method you choose, they will both provide a sense of control and real progress.

Earn More Money

If you’ve been working really hard, now is a great time to ask for a raise. If you ask your employer for a raise, you will you will get either a “yes,” a “no,” or a “maybe.” Any raise you receive can be earmarked toward paying down more debt using the snowball or avalanche method. If you are in sales and have an extraordinary month, reward yourself with something fun, then pay down a chunk of your debt with the rest. If there are no options for earning more money at work, then take advantage of the gig economy that allows any of us to efficiently earn money on the side. There are multiple ways to earn an income; just see my previous blog post, JOY of Always Earning Income.

When you have debt, the key is giving that new money a job, and that job is paying down debt. Again, try not to get lost in the debate of good debt versus bad debt. We’re just talking about how to pay off debt, period. If you get through your credit cards, student loans, your car loan, and all you have left is your mortgage, start paying that down too. Debt is not evil, but it is not great, it is not fun, and if you can earn extra money, it doesn’t need to be a part of your life for long. The lower your debt, the more control you have over your choices, your current life, and your future.

Negotiation & Bankruptcy

If you have lost your job or ability to work, you may be forced into asking your creditors to reduce your debt in a negotiation. If they agree to give you some debt relief, the agreement may still be reported negatively on your credit report, and, in turn, negatively affect your credit score. And a low credit score may hurt your ability to receive additional, potentially needed credit in the near future but hey, you may not be worried about that at the moment you're just trying to increase your net worth. Negotiation is the second-to-last resort for eliminating your debt. The absolute last resort is filing for bankruptcy. Bankruptcy is a financial status, and it’s all a court proceeding. You go to court, speak with a judge and explain why there’s no way you could pay back the money you owe. Just think about that. I have known people who have filed for bankruptcy, and it is a difficult step to take emotionally. If you do take that emotional journey, you will be served well to learn as much about the process as possible.

There are two types for individuals: chapter 13 and chapter 7. Chapter 13 will give you the option of keeping all of the things you have purchased and working through a plan to pay back what you can over a specific time period. It’s considered a “reorganization” of debt, which is a relief, but expect this history to stay in your virtual credit file/credit report for seven years. Chapter 7 bankruptcy is a whole other level that will likely require you to sell some of your things to pay back some of your debt. This could include your car and your home, depending on the latest exemption amounts. As you might expect, taking this kind of action to reduce your debts is a serious legal and financial matter. This will be reported to the three credit bureaus/reporting agencies and will remain in your credit file for up to ten years. If you have your income and your health, negotiating debt reduction and/or filing bankruptcy need not be on your radar. Those are the extreme options. I really don’t want anyone to have to think about these options if you can otherwise avoid them. But sometimes you can't, so now you know.

In Summary

There are many ways to pay down debt once you make the decision to do what it takes. Methods like avalanche or snowball help to create momentum for paying down debts even when becoming "debt-free" may take a while. Sometimes earning additional income through a raise at work or a side job is an option for directing new money at pulverizing your debt. This is the "virtuous circle" option because after your debt is paid off, you'll still make more money that you can apply to savings and continue to increase your net worth. Other options for reducing debt in general include negotiating for lower payments, longer terms, or lower interest rates with creditors. There are an entire list of options for reducing debt on two of the most common debts: student loans and home mortgages. In my book, JOY of Financial Planning I go into more detail about those options. If nothing else works, bankruptcy is an option, but if possible, make it the last of the last resorts.

My goal is to encourage and empower good people to build family wealth and become patriarchs and matriarchs of the community. I hope this helps.

Thank you in advance for your service.

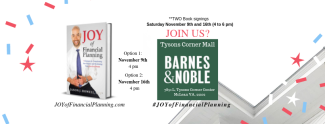

Jason Howell is a CERTIFIED FINANCIAL PLANNER™ professional, former U.S. Congressional candidate and President of Jason Howell Company. With an emphasis on family wealth and time management, the Jason Howell Company develops parents into future patriarchs and matriarchs. Jason is also the the author of JOY of Financial Planning: 7 Strategies for Transforming your Finances and Reclaiming your American Dream (Release date: Fall 2019).

To book an introductory call, click this link to choose a day/time: Free Consultation