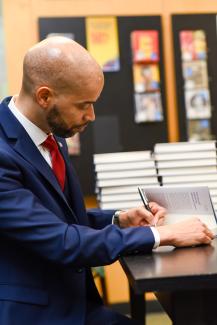

Jason Howell, CFP®, CPWA®, CSRIC®

Serving Family Businesses in the 2020s and Beyond

Belief

Advice given to the wealthiest families can be learned, taught and applied to families with less than $100 million dollars.

Ultra-High Net Worth Advice

How is it that some families are able to achieve and seemingly so many more "fail?" What do successful families know about - and more importantly implement - to preserve wealth and the family? Part of the answers are embedded in the depth of service to ultra-high net worth clients offered below:

- Comprehensive, fiduciary advice

- Advisors who spoke to each other

- Established family structure: family business, family council, family assembly

- Family employment, investment, philanthropic and education policies

- Clear interpretation of family history, mission, values and goals

- Collective and individual involvement in the community

- Knowledge of where the money came from

- Clear understanding of where the money was going

- A sense of independence, self worth and direction

- plans for every member of the family

- a clear definition for what success looked like

- Formal and informal, regularly scheduled, family meetings

Family Office

Since the days of the Roman Empire (and probably before), the ultra-wealthy have been served the best the world has to offer. Whether it was Julius Caesar, Queen Elizabeth II or John D. Rockefeller Sr., the extraordinarily rich have animated the imagination of what truly is comprehensive wealth management. If you could design an organization with a staff that would coordinate investment advisers, estate planners, tax attorneys, CPAs, trust attorneys, bankers, foundations, bookkeepers and even "daily money managers" just for you, your finances would be well taken care of wouldn't they? Yes, they would. And that organization exists: it's called a "Family Office."

Whether it was Caesar, the Emperor of China or the King of Timbuktu before them, small teams of people that did nothing but manage all aspects of wealth has been common throughout history. Consulting firm Deloitte was kind enough to provide a visual history of family offices showing John Pierpont "J.P." Morgan as perhaps the first to set one up a company - "The House of Morgan" - just to manage family assets. Not surprisingly, Morgan Stanley is one of the firms that has made freely available a "best practices report" (72 pages) of how to run a family office. That these offices existed and exist is not a shock. The surprise is that coming faster than the "regular" financial industry expects, "The Millionaire Next Door" - the poor saps worth merely $2MM to $20MM - will soon expect to be served from financial head to toe like the centimillionaires. How will they come to expect a deeper, more comprehensive level of service? I'm going to tell them.

Family Governance

Family Governance has many definitions. From my book JOY of Financial Planning: 7 Strategies for Transforming Your Finances and Reclaiming Your American Dream. the very first section is about Family Governance. In the book I define it this way:

"The system for creating family harmony, preserving family history, and nurturing family values and wealth through the purposeful structure and stewardship of the founding family members."

Columbia University Business School (CBS) has an entire certificate program based on how to serve the vast community of complex family enterprises that comprise your neighborhood landscaping business to the Fortune 500. This program was led luminaries in the little known but specialized industry of complex family enterprises. In 2012, Harvard Business Review referenced Boston Consulting Group's research on family businesses highlighting the "powerful role" they play in the world economy. Those who publish research on family businesses like FamilyBusiness.org highlight statistics like "family business employ 62% of the workforce" and "family business contribute 64% of the GDP." These numbers and many others highlight the importance of these organizations and these families. They are important enough to inspire advocacy groups, advisory groups, and membership organizations to serve them. But too often these groups and organizations are serving exclusively the "centimillionaire" family and above.

That's what's changing.

Colombia Business School (CBS) defines family governance as "a process" for guiding a family's collective endeavors based on an agreed upon set of principles that are put into place through specific policies and practices." That definition though perhaps more formal, sounds too much like it belongs to the description of the Crown Estate of the Royal Family. Patricia Angus, a legal and strategic advisor to global families does a great job of defining family governance through what she calls the family governance pyramid: principles, policies and practices.

- "Principles" are meant to encapsulate the family's beliefs, mission, values, guiding principles and standards.

- "Policies" are the rules of the road where families establish a family constitution or just guidelines for family members

- "Practices" are the habits and the discipline used to when implementing principles and policies

It's within the Angus "Family Pyramid" where the state of governance can be evaluated. Is this family on the right track with their values, beliefs, communication and then by default their finances? It's within books like Wealth of Wisdom: 50 Questions Wealthy Families Ask that I confirmed all families could benefit from instruction, organization, inspiration and multi-layered "governance" that previously has been preserved for the most wealthy. Because of the phenomenon of high taxes and the fear that family wealth could disappear in three generations or less, consultants and advisors were sought after aggressively. Considering what they are asked to do, the fees charged by these consultants are more than reasonable. But until now, it hasn't seemed obvious to those who provide those services to take at least one step down from the ivory tower to assist those "next door" millionaires.

Family Business

"Business ownership is a significant portion of family wealth, representing 34% of non-financial assets."

There are no shortage of family businesses that have "made it big." To the surprise of some, companies like Walmart, Nike, Samsung, Chick-fil-A, Comcast, Dell, Nordstrom, Porsche, IKEA and about one-third of the Fortune 500 are family businesses. The Family Business Alliance has lots of memorable statistics regarding family businesses like "80-90% of all businesses in North America" are family owned and international family businesses contribute to 64% of Gross Domestic Product (GDP); nearly $6 trillion. So if business ownership comprises most family wealth, and family wealth is most of global wealth, why isn't more being done to support even smaller businesses with families? Why is it if you click the links in the post, all of the consultants, organizations and advisors are names you've never heard of?

The Future

The past, present and future of wealth is family business. In the present, the billion dollar businesses and centimillionaire families are somewhat served by a plethora of consultants and organizations. And that is good. But there are entrepreneurs on the cusp of financial and generational success if only they incorporated some of the same best practices. Who is going to serve them? Not the consultants and organizations I have highlighted here. There just isn't a fit between what those consultants do and family firms worth less than $100 million.

But this is changing.

There are certainly firms like mine, armed with the expertise, patience and access to networks that can serve your first generation lawncare businessman that's about to transition the practice his son or daughter. We can serve that regional construction business your friend's mom or dad started 30 years ago that's now ready to transition. We can certainly serve the family that owns a few bars and restaurants and is looking for ways to maximize value and pass it down to the next generation of the family.

How do we do it?

The first step for beginning the process of transition is increasing communication. Likely there is a vision that the founder has exemplified throughout the life of the family business but perhaps never took the time to write down. A good consultant will work with the founder to articulate what that vision was and how it has manifest over the years. A second step is getting a feel for the "corporate governance" meaning, how the company was set up at the beginning, who were and are the owners and were their responsibilities ever written down. Sometimes gathering tax returns in addition to other corporate documents helps with this phase. If there are any "directors" (i.e. "board of directors) besides the owners, this might be a good time to identify those as well. And naturally have a discussion about the state of the employees and their customer base makes sense too.

Once all of the important stakeholders have been identified and introduced, the third step is to create some new roles and committees. In all likelihood, there are informal leaders but explicit versus implied authority tends to reduce tension in the long-term; especially when family is involved. Setting up a "family council" as one of the first committees and empowering them to revisit any employment, meeting, or dividend (profit) distribution policies is a necessary fourth step. In may not make sense at that stage to actually change anything, but looking at it with fresh eyes before a more broad family meeting is just smart.

Depending on the size of the next generation - and the age! - hosting a family assembly meeting for the purpose of discussion only is an appropriate fifth step. This is the new beginning of the process for creating a "family constitution" or "family charter" that will eventually guide both the family business and the wealth it creates long into the future. In this meeting the introduction of the "family council" makes sense but also allowing individuals to choose different task forces/committees they'd like to be on creates necessary buy-in going forward. For example, there could just be an "events committee" that's in charge of planning these family meetings going forward. It's something that family members who are less directly involved in the family business may enjoy doing.

Over the course of successful family assembly, family council and individual committee meetings, the family joint discuss and agree upon:

- Family mission and values

- Family meeting schedules

- Family principles and policies for implementing them

- Who is involved in making decisions, how and when

- What outside advisors are needed (lawyers, financial advisors, etc.)

- What role will philanthropy play on a family and individual basis

This could be called a sixth step but there are so many meetings and conversations it could be sixth through twentieth! The important thing is before we get to the important questions of whether to sell the business or merge or pass it down, we build trust and understanding amongst all family members.

Putting it all Together

There has always been outsized wealth and expertise applied to preserve and grow it. Wealth has historically come from business, specifically family business. Over the decades there is a quiet industry serving the largest family businesses some of which are public companies and others just historically huge. But there is room for advisers willing and able to serve family businesses on the cusp of generational change. Firms like the Jason Howell Company are poised to serve those families with patience, expertise and many of those same best practices. It is time that small and mid-size family businesses benefited from this expertise.

In the present they will prefer it and in the future, all family businesses will demand it.

Jason Howell Company is a family wealth management firm that diversifies the portfolios and untangles the emotions associated with first generation wealth and family business. We help couples overcome financial imposter syndrome and family businesses diversify their risk and implement family governance structures.

Jason J. Howell, CFP®, CPWA®, CSRIC® and Douglas W. Tees, MBA, CFP® CAP®, CBDA have spent a lot of time in the Washington, DC area, and are aware that many people who are first generation wealth suffer from a kind of "financial imposter syndrome." Successful entrepreneurs and family businesses are always looking over their shoulder; government contractors worry about the next contract; former Capitol Hill staffers privately wonder if they should "feel bad" for the money they now make. Imposter syndrome is common among people who work for the many corporate headquarters based in this area as well. These feelings get in the way of properly managing family wealth. We empower them to get organized, build a team of advisors and make decisions.

Our typical "first generation wealth" families include dual income parents who work, save and have just the right amount of fun. For long-time, family owned businesses we focus on much family preservation as we do wealth preservation.

First generation wealth success stories and family business owners realize that they:

- Need to “do something” with the cash in their checking/savings

- Need to eventually diversify their portfolio away from the family business

- Need an investment strategy for “up” and “down” markets

- Need a plan to mitigate market, credit, inflation, and political risks

- Need to start tax planning instead of just tax paying

- Need to be sure they are choosing the right work benefits

- Need to reduce financial miscommunications between family members

- Need to separate business finances from personal finances

- Need to separate family wealth from individual wealth

- Need a plan to provide space for both family and individual philanthropy

- Need to plan for money while alive and for what happens after death